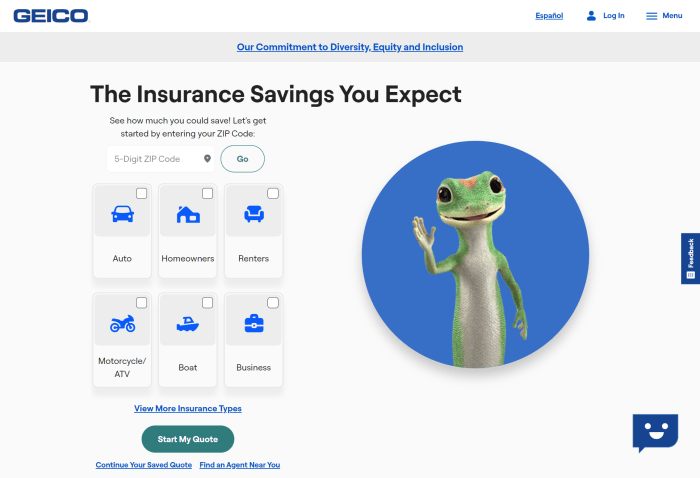

Exploring the realm of Geico Commercial Auto Insurance Coverage for Delivery Companies opens up a world of possibilities and crucial information for businesses in the delivery sector. Dive into this guide to understand the nuances of coverage options, benefits, and more.

Overview of Geico Commercial Auto Insurance for Delivery Companies

Delivery companies rely heavily on their vehicles to transport goods and services efficiently. It is crucial for these businesses to have commercial auto insurance to protect their vehicles, drivers, and assets in case of accidents or unforeseen events. Geico offers comprehensive coverage options tailored specifically for delivery businesses to ensure they are adequately protected on the road.

Coverage Options Offered by Geico

- Liability Coverage: Geico provides coverage for bodily injury and property damage caused by your delivery vehicles.

- Collision Coverage: This option covers the costs of repairing or replacing your vehicles in case of a collision.

- Comprehensive Coverage: Geico offers protection for non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: In the event of an accident with an uninsured or underinsured driver, Geico ensures you are still covered.

Benefits of Choosing Geico

- Competitive Rates: Geico offers affordable rates for commercial auto insurance, helping delivery companies save on costs.

- 24/7 Claims Service: With Geico, you have access to round-the-clock claims service to report accidents and file claims quickly.

- Fleet Discounts: Delivery companies with multiple vehicles can benefit from fleet discounts offered by Geico to further reduce insurance costs.

- Customized Policies: Geico understands the unique needs of delivery businesses and offers customized policies to ensure adequate coverage.

Types of Coverage Offered by Geico

When it comes to protecting your delivery company, Geico offers a range of coverage options to ensure you are prepared for any situation that may arise on the road. Let's take a closer look at the different types of coverage available and how they can benefit your business.

Liability Coverage

Liability coverage is essential for delivery companies as it provides protection in case your driver is at fault in an accident that causes damage to another person's property or injures someone. This coverage can help cover the costs of medical bills, property damage, and legal fees.

For example, if one of your delivery drivers accidentally rear-ends another vehicle while making a delivery, liability coverage would help cover the costs of repairing the other driver's car and any medical expenses they may have incurred.

Collision Coverage

Collision coverage is another important type of coverage offered by Geico for delivery companies. This coverage helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object. For instance, if one of your delivery vans collides with a parked car while out on a delivery route, collision coverage would help cover the costs of repairing the damage to your vehicle.

Comprehensive Coverage

Comprehensive coverage is designed to protect your delivery vehicles from non-collision incidents such as theft, vandalism, or weather-related damage. This coverage can be valuable for delivery companies that operate in areas prone to theft or extreme weather conditions. For example, if one of your delivery trucks is broken into and valuable packages are stolen, comprehensive coverage would help cover the cost of replacing the stolen items.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is crucial for delivery companies as it provides protection in case your driver is involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. This coverage can help pay for medical expenses and vehicle repairs if your driver is hit by an uninsured or underinsured motorist while on a delivery route.

Requirements and Eligibility for Geico Commercial Auto Insurance

Delivery companies looking to qualify for coverage with Geico Commercial Auto Insurance must meet certain eligibility criteria. These requirements are in place to ensure that businesses have the necessary qualifications to receive the coverage they need.

Eligibility Criteria for Delivery Companies

- Delivery companies must have a valid commercial driver's license for all drivers operating company vehicles.

- Businesses must have a clean driving record and maintain a safe driving history to be eligible for coverage.

- Companies must provide information about the types of vehicles used for delivery and the estimated mileage they will cover.

Specific Requirements for Delivery Businesses

- Delivery companies may need to provide proof of business registration and any necessary permits or licenses required to operate in their area.

- Businesses must disclose any previous insurance claims or driving violations to determine their eligibility for coverage.

- Companies may need to undergo a vehicle inspection to ensure that all vehicles meet safety standards and are in good working condition.

Customizing Coverage Based on Unique Needs

Geico Commercial Auto Insurance allows delivery businesses to customize their coverage based on their unique needs. This flexibility enables companies to tailor their insurance policy to meet specific requirements and ensure adequate protection for their operations. By working closely with Geico representatives, businesses can choose the right coverage options and limits that align with their business goals and risk management strategies.

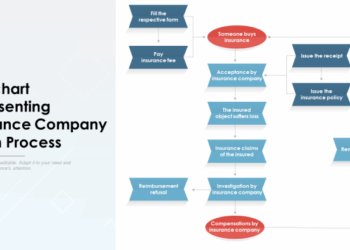

Claims Process and Support for Delivery Companies

When it comes to handling claims, Geico Commercial Auto Insurance provides a streamlined process specifically tailored for delivery companies. In the unfortunate event of an accident or damage to your delivery vehicle, it is crucial to understand the steps involved in filing a claim and the support available to ensure a smooth resolution.

Claims Process for Delivery Companies

- Report the incident: As soon as an accident occurs, contact Geico's claims department to report the details of the incident and initiate the claims process.

- Documentation: Provide accurate and thorough documentation, including photos of the damage, police reports (if applicable), and any other relevant information to support your claim.

- Assessment: A claims adjuster will assess the damage to your vehicle and determine the coverage applicable based on your policy.

- Repairs: Geico works with authorized repair shops to ensure quality repairs are carried out promptly to get your delivery vehicle back on the road.

Support and Resources for Delivery Companies

- Dedicated Claims Representatives: Geico provides delivery companies with dedicated claims representatives who understand the unique needs of the industry and can offer personalized support throughout the claims process.

- 24/7 Support: Geico offers round-the-clock support to assist delivery companies in reporting claims and addressing any concerns or questions they may have.

- Online Tools: Utilize Geico's online portal to track the progress of your claim, upload documents, and communicate with the claims team efficiently.

Tips for Expedited Claims Processing

- Act quickly: Report the incident promptly to start the claims process without delay.

- Provide detailed information: Ensure all documentation is accurate and complete to expedite the assessment and decision-making process.

- Stay in communication: Keep in touch with your claims representative and respond promptly to any requests for additional information to avoid delays.

- Know your coverage: Understand the coverage provided by your policy to maximize benefits and ensure a smooth claims process.

Cost and Pricing Structure

When it comes to pricing commercial auto insurance for delivery companies, Geico follows a structured approach that takes various factors into consideration. The cost of insurance premiums can vary based on multiple elements, and understanding these factors can help businesses make informed decisions when it comes to their insurance needs.

Factors Influencing Cost

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums.

- Type of Vehicles: The make, model, and age of the vehicles used for delivery can impact insurance costs.

- Coverage Limits: The level of coverage chosen by the business can affect the overall cost of the insurance policy.

- Annual Mileage: The number of miles driven annually for delivery purposes can influence premium rates.

- Location: The area where the business operates and the risk associated with that location can impact pricing.

Tips to Lower Insurance Costs

- Bundle Policies: Consider bundling commercial auto insurance with other business insurance policies for potential discounts.

- Safety Measures: Implement safety measures such as driver training programs or installing safety devices in vehicles to reduce risks and lower premiums.

- Shop Around: Compare quotes from different insurance providers to find the best rates and coverage options for your delivery company.

- Review Coverage: Regularly review your insurance coverage to ensure you are not paying for more coverage than you need.

Epilogue

In conclusion, Geico stands out as a reliable choice for delivery companies seeking robust commercial auto insurance coverage. With customizable options, efficient claims support, and competitive pricing, Geico caters to the diverse needs of businesses in the delivery industry.

Top FAQs

What are the coverage options specifically tailored for delivery companies by Geico?

Geico offers comprehensive coverage options such as liability insurance, collision coverage, and cargo insurance to address the unique needs of delivery businesses.

How can delivery companies customize their coverage with Geico?

Businesses can tailor their insurance plans with Geico by selecting specific coverage types, adjusting coverage limits, and adding endorsements to suit their individual requirements.

What factors can impact the cost of insurance premiums for delivery companies with Geico?

Insurance premiums may vary based on factors like the number of vehicles insured, driving records of employees, type of cargo transported, and the coverage limits chosen by the business.